-

嘉兴嘉兴

运营管理总部

电子材料核心基地

智能装备核心基地

电子部品基地

泛半导体产业园

尖山电子粉体材料基地

研究院管理总部

天通国际智慧港

-

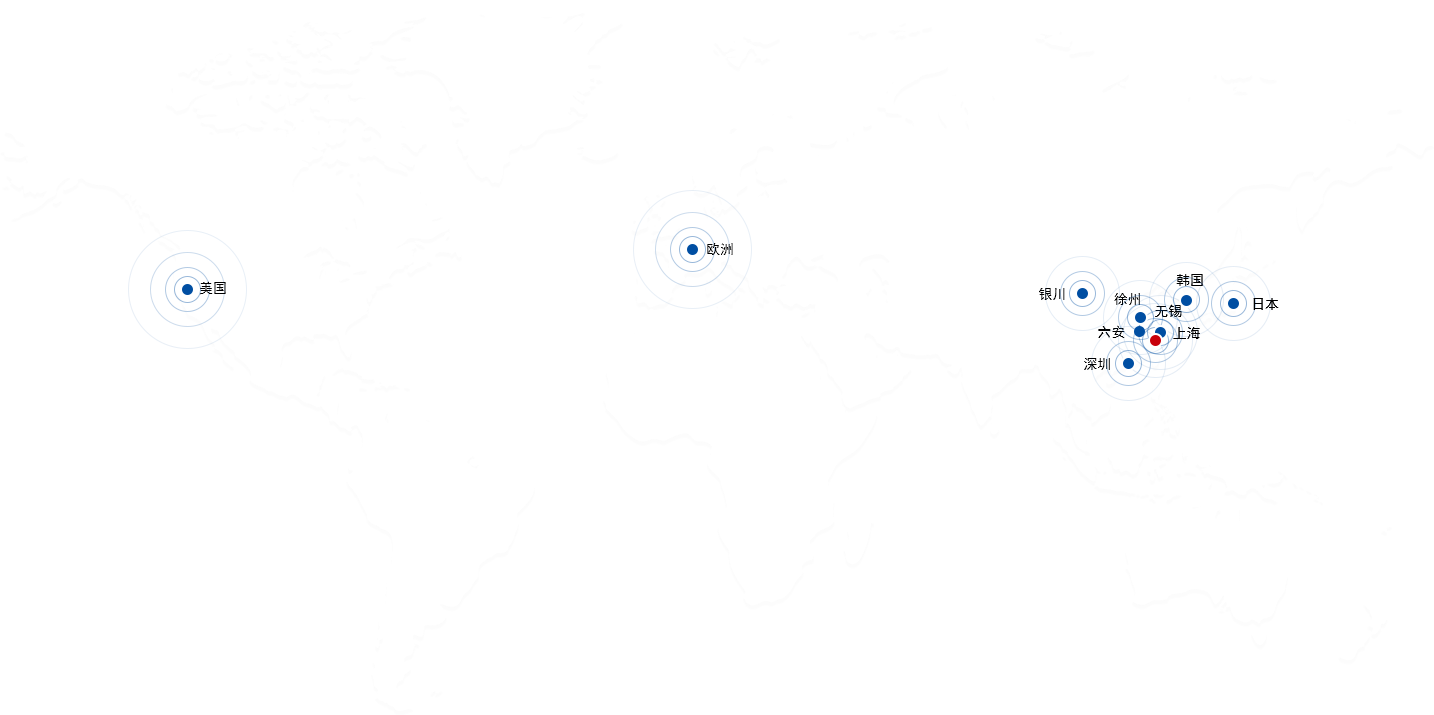

美国美国

-

欧洲欧洲

-

银川银川

晶体材料基地(晶体生长及制造)

-

深圳深圳

全球客服中心

-

六安六安

电子材料基地(软磁元件制造)

-

徐州徐州

电子材料基地(晶片技术及制造)

-

上海上海

投资管理总部

-

韩国韩国

-

日本日本

放眼全球 引领行业

夯实三大产业,优化产业结构,确立各自行业优势、打造世界品牌。

运营管理总部

电子材料核心基地

智能装备核心基地

电子部品基地

泛半导体产业园

尖山电子粉体材料基地

研究院管理总部

天通国际智慧港

晶体材料基地(晶体生长及制造)

全球客服中心

电子材料基地(软磁元件制造)

电子材料基地(晶片技术及制造)

投资管理总部